By Anna Leah Gonzales

MANILA – Authorities seized 18,811 illicit vape products and counterfeit tax stamps with a total tax deficiency of PHP36.51 million.

In a statement Wednesday, the Bureau of Internal Revenue (BIR) said the illicit vape products were confiscated during a raid, along with the National Bureau of Investigation (NBI)-Organized and Transnational Crimes Division, in Guiguinto, Bulacan on May 30.

The BIR said the enforcement operation was the product of surveillance of online sales activities on Facebook.

“We want to send a loud and clear message to those selling illicit vape products: the BIR and NBI will pursue you wherever you hide—online or onsite. The long arms of the law extend into the cyber realm—and we will find you,” BIR Commissioner Romeo Lumagui Jr. said.

“We will pull out all the stops. Online or onsite, the BIR will do everything it can to stop illicit trade.”

The team raided a vape lounge operating as a front for underground vape distribution and a makeshift warehouse located in a residential house.

Inside the premises, authorities found 4,789 salt nicotine units and 14,022 conventional vape products, along with fake internal revenue excise stamps and counterfeit disposable vapes.

“To put the scale of the haul into perspective—kung conservative po tayo—assuming one disposable vape lasts an average user one week, this means that 18,811 seized units could supply over 4,700 underage users for a month, assuming each one vapes daily,” Lumagui said.

“So, close to 5,000 kids could be vaping for an entire month from the products we seized in just one operation. These aren’t just tax violations—they are threats to the health of our children. That’s why we’re going after illicit traders, whether they operate in public markets or hide behind Facebook accounts and residential homes.”

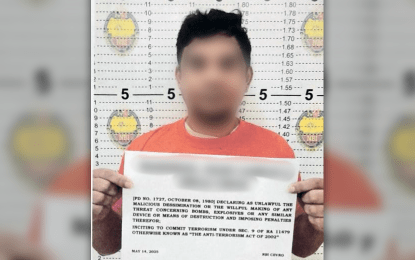

Several employees found manning the online and onsite operations during the raid including online sales agents are set to be charged criminally, alongside the proprietor, for multiple violations of the National Internal Revenue Code.

Charges under Article 172 of the Revised Penal Code or the Falsification of Commercial Documents are also being prepared.

The BIR said excise tax collections increased following the rollout of its digital stamp verification system last year.

In 2023, 11.2 million milliliters of vape liquids were taxed, generating PHP223.75 million.

Collections surged to PHP942 million after the stamp system’s implementation in June 2024.

“Illicit vape sellers are hiding their products in residential houses. They are hiding their illicit operations in residential communities. If you suspect that your neighbor is engaged in the selling or warehousing of illicit vape products, immediately report the same to the BIR. Illicit vape criminals have no place in our neighborhoods,” Lumagui said. (PNA)